an ordinary trading page based on technical trading... (since 2008)

1. "MUST" take every signal shown by system

2. "NEVER" invest > 30% out from capital, balance capital for backup

3. "INCREASE" position only after 20-30% increase in capital

*Futures Crude Palm Oil: current position for GT2

Step 1: Holding> February contract LONG 3053 (01.12.11)

Step 3: Entry> No SAR signal yet..

*Futures Kuala Lumpur Index: current position for RJ1

Step 1: Holding> LONG 1436 November (24.11.11)

Step 2: Stop> i dont use STOP!!

Step 3: Entry> No SAR signal yet..

*will be updated after market

*PLEASE SCROLL DOWN DOWN DOWN TO VIEW MY GT2 SYSTEM PERFORMANCE

Wise Words from Ed Seykota

Friday, December 2, 2011

CPO GT2 and GT3 Trade Update : 2nd December 2011

Both systems took a loss of 12pts per contract from previous short at 3052.

As of today, both systems holding long February CPO contracts at 3065.

Thursday, December 1, 2011

CPO GT2 and GT3 Trade Update : 1st December 2011

Both systems realised a profit of 27pts per contract from previos short at 3080.

As of today, both systems holding long February contracts at 3053.

Saturday, November 26, 2011

DowJones Trade Signal

1)21.05>SHOT 12714-BUY 11245 = +1469 (17.07)

2)17.07>LONG 11245-SELL 11386 = +141 (24.07)

3)30.07>LONG 11399-SELL 11449 = +50 (18.08)

4)18.08>SHOT 11449-BUY 11633 = -184 (28.08)

5)28.08>LONG 11633-SELL 11339 = -294 (04.09)

6)18.09>SHOT 11036-BUY 9285 = +1751 (29.10)

7)19.11>SHOT 7964-BUY 8832 = -868 (08.12)

8)08.12>LONG 8832-SELL 8363 = -469 (14.01) >> 2008= +1596

-------------------------------------------------------------------

2009

9)20.01>SHOT 7994-BUY 8342 = -348 (28.01)

10)02.02>SHOT 7908-BUY 8163 = -255 (06.02)

11)12.02>SHOT 7844-BUY 6980 = +864 (11.03)

12)23.02>LONG 7572-SELL 7549 = -23 (30.03)

13)02.04>LONG 7932-SELL 7869 = -63 (20.04)

14)29.04>LONG 8128-SELL 8357 = +229 (13.05)

15)21.05>SHOT 8229-BUY 8497 = -268 (29.05)

16)29.05>LONG 8497-SELL 8632 = +135 (15.06)

17)22.06>SHOT 8460-BUY 8581 = -121 (15.07)

18)17.07>LONG 8740-SELL 9215 = +475 (17.08)

19)17.08>SHOT 9215-BUY 9425 = -210 (21.08)

20)21.08>LONG 9425-SELL 9458 = +33 (31.08)

21)10.09>LONG 9631-SELL 9724 = +93 (24.09)

22)30.09>SHOT 9640-BUY 9835 = -195 (08.10)

23)12.10>LONG 9918-SELL 9938 = +20 (22.10)

24)26.10>SHOT 9915-BUY 9970 = -55 (05.11)

25)06.11>LONG 10014-SELL 10255 = +241 (27.11)

26)04.12>LONG 10514-SELL 10310 = -204 (08.12) >>2009= +348

-------------------------------------------------------------------

2010

27)24.12>LONG 10515-SELL 10560 = +45 (20.01)

28)26.01>SHOT 10156-BUY 10439 = -283 (02.03)

29)02.03>LONG 10439-SELL 10240 = -199 (20.05)

30)20.05>SHOT 10240-BUY 10408 = -168 (23.07)

31)23.07>LONG 10408-SELL 10208 = -200 (20.08)

32)20.08>SHOT 10208-BUY 10477 = -269 (13.09)

33)13.09>LONG 10477-SELL 11896 = +1419 (15.03) >>2010= +345

--------------------------------------------------------------------

2011

34)15.03>SHOT 11896-BUY 12273 = -377 (29.03)

35)29.03>LONG 12273-SELL 12330 = +57 (25.05)

TOTAL profit/loss = +1018

Friday, November 25, 2011

CPO GT2 and GT3 Trade Update : 25th November 2011

Both systems took in a loss of 50pts per contract from previous long at 3130.

As of today,both systems are short February contracts at 3080.

Thursday, November 24, 2011

FKLI 2011 PERFORMANCE (RJ1)

61)31.01>Feb, LONG 1511-SELL 1500 = -11 (10.02)

63)28.02>Mac, SHOT 1479.5-BUY 1519.5 = -40 (29.03)

64)29.02>Mac, LONG 1519.5-SELL 1543.5 = +24 (31.03)

65)31.03>April, LONG 1541-SELL 1532 = -9 (29.04)

TOTAL POINTS SINCE 2008 = +623 points

CPO GT2 and GT3 Trade Update : 24th November 2011

Both systems took in a 14pts profit per contract from yesterday's short at 3144.

As of today both systems are holding long CPO February contracts at 3130.

Wednesday, November 23, 2011

CPO 2011 PERFORMANCE (RJ1)

72)07.01>SHOT 3761-BUY 3764 = -3 (19.01)

APRIL 2011 contract

73)19.01>LONG 3723-SELL 3630 = -93 (26.01)

74)26.01>SHOT 3630-BUY 3749 = -119 (31.01)

75)31.01>LONG 3749-SELL 3933 = +184 (14.02)

MAY 2011 contract

76)14.02>LONG 3892-SELL 3765 = -127 (16.02)

79)09.03>SHOT 3570-BUY 3438 = +132 (18.03)

JUNE 2011 contract

80)18.03>LONG 3414-SELL 3311 = -103 (22.03)

81)22.03>SHOT 3311-BUY 3311 = -0 (30.03)

82)30.03>LONG 3311-SELL 3300= -11 (14.04)

CPO GT2 and GT3 Trade Update : 23rd November 2011

As of today both systems holding short at 3147 February CPO contracts.

NASDAQ Trade Signal

1)23.06>SHOT 2387-BUY 2297 = +90 (17.07)

2)23.07>LONG 2321-SELL 2403 = +82 (18.08)

3)26.08>SHOT 2359-BUY 2269 = +90 (19.09)

4)29.09>SHOT 2146-BUY 1783 = +363 (04.11)

5)19.11>SHOT 1427-BUY 1536 = -109 (08.12)

6)08.12>LONG 1536-SELL 1492 = -44 (14.01) >> 2008= +472

-------------------------------------------------------------------

2009

7)20.01>SHOT 1455-BUY 1539 = -81 (28.01)

8)06.02>LONG 1569-SELL 1492 = -77 (17.02)

9)17.02>SHOT 1492-BUY 1371 = +121 (11.03)

10)17.03>LONG 1446-SELL 1486 = -40 (30.03)

11)02.04>LONG 1588-SELL 1702 = +114 (12.05)

12)12.05>SHOT 1701-BUY 1748 = -47 (19.05)

13)27.05>LONG 1768-SELL 1817 = +49 (15.06)

14)22.06>SHOT 1784-BUY 1838 = -54 (26.06)

15)16.07>LONG 1864-SELL 1976 = +112 (06.08)

16)17.08>SHOT 1949-BUY 2016 = -67 (21.08)

17)21.08>LONG 2016-SELL 1992 = -24 (01.09)

18)08.09>LONG 2035-SELL 2117= +83 (24.09)

19)01.10>SHOT 2084-BUY 2142 = -58 (12.10)

20)14.10>LONG 2165-SELL 2141 = -24 (22.10)

21)27.10>SHOT 2129-BUY 2102 = -27 (05.11)

22)16.11>LONG 2180-SELL 2144 = -36 (19.11)

23)27.11>SHOT 2136-BUY 2190 = -54 (02.12) >> 2009= -110

-------------------------------------------------------------------

2010

24)04.12>LONG 2206-SELL 2284 = +78 (12.01)

25)26.01>SHOT 2199-BUY 2242 = -43 (26.02)

26)26.02>LONG 2242-SELL 2227 = -15 (20.05)

27)20.05>SHOT 2227-BUY 2270 = -43 (26.07)

28)26.07>LONG 2270-SELL 2162 = -108 (16.08)

29)16.08>SHOT 2162-BUY 2263 = -101 (13.09)

30)13.09>LONG 2263-SELL 2694 = +431 (11.03) >> 2010= +199

--------------------------------------------------------------------

2011

31)11.03>SHOT 2694-BUY 2796 = -102 (08.04)

32)01.04>LONG 2796-SELL 2749 = -47 (24.05)

TOTAL profit/loss = -258

Tuesday, November 22, 2011

CPO GT2 and GT3 Trade Update : 21st2nd November 2011

As a result, both systems realised a gain of 34pts from yesterday's short at 3182.

As of today, both systems holding long February CPO contracts at 3182.

Monday, November 21, 2011

CPO GT2 and GT3 Trade Update : 21st November 2011

Both systems took in a loss of 45pts per contract.

As of today, both systems are holding long February contracts at 3216!

Friday, November 18, 2011

CPO GT2 and GT3 Trade Update : 18th November 2011

Both systems suffered a loss of 23pts from yesterday's short at 3238.

As of today,both systems holding long February CPO at 3261.

Thursday, November 17, 2011

CPO GT2 and GT3 Trade Update : 17th November 2011

GT2 and GT3 took in a profit of 9 miserable points from yesterday long at 3229.

As of today both systems are holding short February contracts at 3238.

Wednesday, November 16, 2011

CPO GT2 and GT3 Trade Update : 16th November 2011

Both took in a loss of 55pts from previous short at 3174.

As of today both GT2 and GT3 holding long February CPO contract at 3299.

Tuesday, November 15, 2011

CPO GT2 and GT3 Trade Update : 15th November 2011

As of today both systems still holding yesterday's short February CPO at 3174.

Monday, November 14, 2011

CPO GT2 and GT3 Trade Update : 14th November 2011

GT2 signaled a short at 3163 locking in a profit of 78pts from same long as GT3.

Since the roll over time is near, we decided to short Feb CPO contracts as the spread was dead even.

Officially we're short GT2 at 3163 and GT3 at 3174 February contracts.

Thursday, November 10, 2011

CPO GT2 and GT3 Trade Update : 10th November 2011

Both systems signaled a long for January CPO contract at a mind boggling 3085.

Both GT2 and GT3 took in an ass whooping loss of 57pts per contract.

As of today, GT2 and GT3 holding long january CPO at 3085.

Wednesday, November 9, 2011

CPO GT2 and GT3 TRADE UPDATE: 9th Nov 2011

Friday, November 4, 2011

CPO GT2 and GT3 Trade Update : 4th November 2011

GT3 signaled a short at 2994, taking in a profit of 63pts from long at 2931.

GT2 and GT3 again signaled a long at 3018.

For accounting purposes, we are holding long January CPO at 3018 as of today.

Thursday, November 3, 2011

CPO GT2 and GT3 Trade Update : 3rd November 2011

Since it's all accounting, GT2 and GT3 took in a combined intraday gross loss of 66pts per lot today. Trust me, it's very painful ! But that's trading for you...'if you can't stand the heat, get out of the kitchen'!

Wednesday, November 2, 2011

My Small Account Monthly Update: October 2011

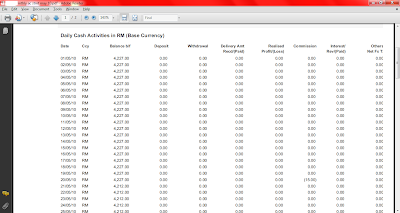

*Above statement for October 2011 at RM26,002.10.. (total wdrawal for 2011 already RM20,000), as can see below its the statement for end December 2010 at RM36,598.38.. so for 2011 currently i'm net profit at RM9,403.72 (per lot trade)

*Above statement for October 2011 at RM26,002.10.. (total wdrawal for 2011 already RM20,000), as can see below its the statement for end December 2010 at RM36,598.38.. so for 2011 currently i'm net profit at RM9,403.72 (per lot trade) *Above statement for December 2010 at RM36,598.38, and below statement in May 2010 when i first started to post one of my trading accounts.. May 2010 at RM 4,212..

*Above statement for December 2010 at RM36,598.38, and below statement in May 2010 when i first started to post one of my trading accounts.. May 2010 at RM 4,212..

CPO GT2 AND GT3 TRADE UPDATE: 2/11/11

GT3 signaled a long at 2931 for January contract, taking in a loss of 2pts from yesterday's short at 2929.

As of 2/11/11 both GT2 and GT3 holding long positions.

Tuesday, November 1, 2011

CPO GT3 TRADE Update : 1st November 2011

From yesterday's long at 2944, Gt3 took a loss of 15pts.

As of today,GT is holding short.

Monday, October 31, 2011

CPO GT3 TRADE Update : 31st October 2011

With that GT3 took in a profit of 42pts from previous short at 2986.

Officially as of 31st October, GT3 is holding LONG January CPO at 2944.

Thursday, October 27, 2011

CPO TRADE GT2 and GT3 Update : 18th October 2011

GT2 locked in a profit of 112pts from previous long at 2874.

GT3 locked in profit of 70pts on Tuesday.

As of today both GT2 and GT3 holding short January CPO at 2986.

Wednesday, October 26, 2011

GT3 TRADE UPDATE 25th OCTOBER 2011

GT3 lock in a profit of 70pts when it sold it's January CPO contract at 2944

As of 25/10/11 GT3 has no open position in CPO.

Wednesday, October 19, 2011

CPO TRADE Update : 19th October 2011

#This is getting irritating, we may be putting in filters for GT3 in the future, as "losses is the

mother of creativity" is our motto!

As of today, both systems are long January CPO at 2974!

Tuesday, October 18, 2011

CPO TRADE Update : 18th October 2011

*GT2 took in a loss of 44points and GT3 lost 58pts.

# As of today, both GT2 and GT3 holding short at 2832.

NB. These losses are getting irritating,but that's trading for you!

Friday, October 14, 2011

CPO TRADE Update : 14th October 2011

GT3 signaled a long December CPO at 2891 today.

GT2 realised a loss of 38pts and GT3 realised a loss of 53pts from the short at 2838.

#As of today, holding long GT2 at 2876 and GT3 2891,both systems still with December CPO.

GOOGLE Trade Signal

1)26.06>SHOT 534-BUY 539 = -$5 (02.07)

2)15.07>SHOT 514-BUY 490 = +$24 (08.08)

3)08.08>LONG 490-SELL 492 = +$2 (19.08)

4)26.08>SHOT 478-BUY 477 = +$1 (02.09)

5)29.09>SHOT 424-BUY 297 = +$127 (08.12)

6)08.12>LONG 297-SELL 293 = -$4 (22.12)

7)31.12>LONG 307-SELL 290 = -$17 (15.01) >> 2008= +$128

-------------------------------------------------------------------

2009

8)20.01>SHOT 285-BUY 309 = -$24 (22.01)

9)04.02>LONG 353-SELL 347 = -$6 (17.02)

10)17.02>SHOT 346-BUY 311 = +$35 (11.03)

11)17.03>LONG 330-SELL 391 = +$61 (13.05)

12)27.05>LONG 406-SELL 410 = +$4 (22.06)

13)15.07>LONG 427-SELL 451 = +$24 (17.08)

14)21.08>LONG 463-SELL 459 = -$4 (31.08)

15)10.09>LONG 467-SELL 491= +$24 (30.09)

16)30.09>SHOT 491-BUY 502 = -$11 (07.10)

17)07.10>LONG 508-SELL 547 = +$39 (27.10)

18)04.11>LONG 540-SELL 617 = +$77 (06.01) >> 2009= +$219

-------------------------------------------------------------------

2010

19)21.01>SHOT 573-BUY 568 = -$5 (10.03)

20)10.03>LONG 568-SELL 544 = -$24 (22.04)

21)22.04>SHOT 544-BUY 489 = +$55 (23.07)

22)23.07>LONG 489-SELL 466 = -23 (20.08)

23)20.08>SHOT 466-BUY 485 = -19 (17.09)

24)17.09>LONG 485-SELL 574 = +89 (30.11)

26)21.12>LONG 598-SELL 600 = +2 (01.03) >>2010= +$51

--------------------------------------------------------------------

2011

27)01.03>SHOT 600-BUY 541 = +59 (07.07)

TOTAL profit/loss = +$407

Thursday, October 13, 2011

CPO TRADE Update : 13th October 2011

Pretty confusing, that means GT3 took a loss of 28pts 3 times today..ie 1)short 2838 from long of 2866 yesterday. 2) long 2866 to reverse earlier short of 2838. 3) short again at close at 2838 to reverse long of 2866.

* Holding short of 2838 as of end of trading today.

It just can't be helped if today was meant to be a whipping day.

ps..Now I know how Singaporeans feel: they get whipped by their own government and by foreigners on a daily basis!

Wednesday, October 12, 2011

RJ1 turning to BLACK again!!!

CPO TRADE Update : 12th October 2011

#That means GT2 took in a loss of 83pts from previous short of 2783 and GT3 took in a loss of 85pts from previous short of 2781. Only RJ1 locked in a profit of 143pts.

#As of today we're holding long December CPO for all 3 systems at 2866.

Friday, October 7, 2011

CPO TRADE Update : 7th October 2011

#GT3 short signal appeared at 2781, locking is a more pathetic profit of 6pts from yesterday's long at 2775.

#Please note that all the signals are for December contracts.

As of today, we're short December CPO contracts.

Thursday, October 6, 2011

CPO TRADE Update : 6th October 2011

*GT2 realised a profit of 51pts and GT3 locked in a profit of 53pts from their respective short at 2826 and 2828.

As of 6th October, we're holding long December CPO at 2775 in both systems.

Tuesday, October 4, 2011

TRADES update: 4th October 2011

# GT3 signalled a short at 2828 also taking in a loss of 87pts per lot from the previous long at 2915 for December CPO contract.

As of today, both GT2 and GT3 are short at 2826 and 2828 respectively.

Thursday, September 29, 2011

Trade updates :29/09/11

#GT3 still no signal to reverse yet. Still holding long December contract at 2915.

Wednesday, September 28, 2011

Trade updates :28/09/11

#GT3 still no signal to reverse.

Monday, September 26, 2011

GT3 UPDATE 26th SEPTEMBER 2011

Coincidentally, this is also the same LONG signal for GT2.

Yep,we know it's scary but things could be worse...we could be Singaporeans! YUCKS! PUI!

Friday, September 23, 2011

A NEW SYSTEM : GT3 TO BE LAUNCHED SOON

Performance wise it mirrors GT2 based on our back testing.

Reason for new system, our funds getting too big to be trading RJ1 and GT2 only.

Will we be creating new systems in the future? Sure,so long as our funds gets bigger.

Why call it GT3? Because we ran out of names.

Happy stress free trading all!

Thursday, September 22, 2011

ANALyst JOKE for 2011..

CPO GT2 TRADE Update: 22nd September 2011

We holding short at 3028 December CPO contract as of this morning.

Monday, September 19, 2011

CPO GT2 TRADE Update: 19th September 2011

No new signals....yet!

Wednesday, September 14, 2011

CPO GT2 TRADE Update: 14th September 2011

*GT2 again signaled a short at 3pm opening at 2993,again we took a loss of 30pts per lot from morning long of 3023.

*Once again our super aggressive GT2 system signaled a long at 3009 and once again we took in a loss 16pts per lot.

At the end of the day, we are holding long November CPO at 3009.

#Getting whipped is part of trading. Thankfully days such as this don't come by very often, but when it does... just bite the bullet,it can't be helped!

Tuesday, September 13, 2011

CPO GT2 TRADE Update: 13th September 2011

Saturday, September 10, 2011

Totally unrelated to trading!

|

Friday, September 9, 2011

CPO GT2 TRADE Update: 9th September 2011

We're holding long November contract at 3055 over the weekend.

Thursday, September 8, 2011

CPO GT2 TRADE Update: 8th September 2011

Tuesday, September 6, 2011

CPO GT2 TRADE Update: 6th September 2011

*Today GT2 signaled a long at 3007,which we took.

*Thanks to perpetual screw up by the over paid and highly incompetent people working in Bursa,we missed adding 30pts per lot profit in to our trading account!

My Small Account Monthly Update: August 2011

Monday, September 5, 2011

Bursa deserves a tongue lashing!

The standard excuse use by Bursa would be your chart provider problem or streamyx problem;please don't believe their excuses!

Also refrain from using vulgarities on them as they'll put down the phone, I know because I used on them 4 letters , 3 syllables and 5 syllables vulgarities!

PUI! to Bursa.

Friday, August 26, 2011

CPO GT2 TRADE Update: 26th August 2811

Please note,we did not long at 2978 as we too would be on holiday ! See you next Friday!

Happy Aidil Fitri to our Muslim readers !

Thursday, August 25, 2011

CPO GT2 TRADE Update: 24th August 2811

NB. Low volatility markets are a nightmare for speculation!!!!

Tuesday, August 23, 2011

CPO GT2 TRADE Update: 23rd August 2011

Please note that we stop and reverse our positions.

Friday, August 19, 2011

CPO GT2 TRADE Update: 19th August 2011

Damn 3000 still a very strong psychological support for CPO!

Wednesday, August 17, 2011

CPO GT2 Trade Update: 17 August 2011

Tuesday, August 16, 2011

CPO GT2 Trade Update: 16 August 2011

Monday, August 15, 2011

CPO RJ1 & GT2 Trade Update: 15 August 2011

Margin Update for FKLI & CPO

Friday, August 12, 2011

CPO GT2 Trade Update: 12 August 2011

Tuesday, August 9, 2011

CPO GT2 Trade Update: 8 August 2011

FKLI & CPO Margin Update

Monday, August 8, 2011

CPO GT2 Trade Update: 8 August 2011

Friday, August 5, 2011

CPO RJ1 & GT2 Trade Update: 4 August 2011

Wednesday, August 3, 2011

CPO RJ1 @ GT2 Trade Update: 3 August 2011

Monday, August 1, 2011

My Small Account Monthly Update: July 2011

Saturday, July 30, 2011

FKLI RJ1 Trade Update: 29 July 2011

Monday, July 25, 2011

CPO RJ1 & GT2 Trade Update: 25 July 2011

Friday, July 22, 2011

CPO GT2 Trade Update: 21 July 2011

Thursday, July 21, 2011

CPO RJ1 Trade Update: 20 July 2011

Tuesday, July 19, 2011

CPO RJ1 & GT2 Trade Update: 19 July 2011

Friday, July 15, 2011

CPO GT2 Trade Update: 15 July 2011

Thursday, July 14, 2011

CPO RJ1 Trade Update: 13 July 2011

Wednesday, July 13, 2011

CPO RJ1 @ GT2 Trade Update: 12 July 2011

Friday, July 8, 2011

CPO RJ1 Trade Update: 8 July 2011

Thursday, July 7, 2011

CPO price falling to dip below RM3,000 per tonne due to rising inventory and decreasing demand

By SHARIDAN M.ALI

sharidan@thestar.com.my

PETALING JAYA: Crude palm oil (CPO) price is likely to fall below RM3,000 per tonne over the next two weeks due to rising inventory and decreasing demand, traders and analysts said.

The last time CPO three-month futures was below the RM3,000 per tonne level was on Oct 21, 2010 at RM2,990. Since then it had been climbing to reach a peak of RM3,955 on Feb 11.

The CPO three-month futures price had been on a declining trend for the past five months to close at RM3,029 per tonne, down RM11 yesterday.

Malaysia's CPO stock and production, which have been climbing since February, are playing their part to further suppress the CPO price. Malaysia is the second largest palm oil producer globally after Indonesia.

The latest numbers according to the Malaysian Palm Oil Board (MPOB) monthly statistical data for May showed month-on-month palm oil stocks rose nearly 15% to their highest in 16 months as production overtook exports.

Palm oil stocks in May rose to 1.92 million tonnes from 1.67 million tonnes a month before a level unseen since January 2010 while CPO production shot up by 13.74% to 1.74 million tonnes.

Interband Group of Companies senior palm oil trader Jim Teh expected the CPO price to scale back to around RM2,800 per tonne within the next two weeks as demand was sliding due to the “expensive” CPO price and higher inventory.

“The current CPO price is considered expensive for physical' buyers to keep high inventory on the commodity. They would just buy the CPO as and when they needed it,” he said, adding that besides demand, paper trading of CPO also helped to ramp up its price.

Teh said the healthy production levels in the past three months were supported by good weather that resulted in robust fresh fruit bunches yields.

Nevertheless, Teh argued that even at RM2,800 per tonne, the margin was still good as the production cost of CPO per tonne hovered around RM1,200 to RM1,500.

“It will be a good correction and a breather for the physical buyers to come in and buy CPO as well as to clear the mounting palm oil stock,” he told StarBiz, adding that CPO prices had been rallying since 2006.

The decrease in CPO prices would also very much depend on the latest level of inventory where MPOB is expected to release its June monthly data early next week.

Meanwhile, IJM Plantations Bhd chief executive officer and managing director Joseph Tek Choon Yee remained optimistic that the average CPO price for calendar year 2011 would be higher than last year's RM2,745 and there was still room for it to average at RM3,000.

“The widening soy bean-palm oil discount, presently at US$237 will make palm oil very attractive for soy bean oil buyers such as India. This will certainly lend support to subsequent purchases,” he said.

On rising stockpile, Tek said CPO backed by fresh fruit bunches production was on the rise as the oil palms were recovering from the double whammy weather effects arising from El Nino and La Nina last year and early part of this year.

“This production figures leading toward rising stockpile and lower crude oil prices appear to set some level of panic' selling and lends support to opportunity buying,” he said.

Another analyst, sharing similar views with Teh, also anticipated that the CPO price would dip below the RM3,000 level.

“The inventory level is just quite high right now. Maybe retailers are waiting to buy just before the festive season starting in August.

“The declining CPO prices were also influenced by lower soy bean prices,” he said.

Muslims around the world will start fasting for the whole of August before celebrating the Aidil Fitri.

Palm oil expert Dorab Mistry, director of Godrej International Ltd, was quoted by Bloomberg yesterday as saying the velocity of CPO production was unbelievable.

In April, Mistry revised his earlier CPO forecast given the anticipation of higher global palm oil production this year.

He expected the RM3,000 per tonne price support to be broken and push CPO prices to trade even lower going forward.

OSK Research, which analysed the CPO futures market in June for a few times over a period of three weeks, said that its technical landscape had deteriorated at every subsequent analysis.

“Our major talking point last month was the bottom point of the “non-classical hammer”, or the RM3,163 per tonne level. This is because the RM3,163 per tonne level has been the support floor for the market's six-month old sideways trend.

“However, this crucial low was violated last week and it looks like this violation of the key RM3,103 per tonne support level has confirmed a breakdown,” it said in a report earlier this week.

But, the research house said since the violation of this level was not aggressive enough, it could not tell for sure at this point of time if the RM3,163 per tonne level had been decisively taken out.

“Hence, to confirm that the lowest point of the “non-classical hammer” has really been violated, we would have to wait until prices fall below last week's low of RM3,031 per tonne level,” it said.

**PS>> I love this kind of news from our super analyst.. hehe, go down within 2weeks under 3k posible, my signal also showing i still holding SHOT 3259 for September contract rollover from August contract initial SHOT 3362.. this is the STAR link : I DO HOPE ALL THIS ANALYST ALREADY SHOT WAY HIGHER THEN ME.. muahahahaha

Friday, July 1, 2011

My Small Account Monthly Update: June 2011

CPO GT2 Trade Update : 30 June 2011

Thursday, June 23, 2011

CPO GT2 Trade Update: 23 June 2011

Thursday, June 16, 2011

CPO RJ1 Trade Update: 16 June 2011

Tuesday, June 14, 2011

FKLI & CPO 2011 Performance Update

Thursday, June 2, 2011

My Small Account Monthly Update: May 2011

Monday, May 30, 2011

FKLI RJ1 Trade Update: 27 May 2011

Thursday, May 19, 2011

GT2 Trade Update: 19 May 2011

Monday, May 16, 2011

CPO RJ1 Trade Update: 16 May 2011

Tuesday, May 10, 2011

CPO RJ1 Trade Update: 10 May 2011 (swing)

Monday, May 9, 2011

CPO GT2 update: 9 May 2011

Friday, May 6, 2011

FKLI RJ1 Trade Update: 6 May 2011

Thursday, May 5, 2011

CPO GT2 Trade Update: 5 May 2011

Wednesday, May 4, 2011

CPO GT2 Trade Update: 4 May 2011

Tuesday, May 3, 2011

My Small Account Monthly Update: April 2011

Thursday, April 28, 2011

CPO GT2 Trade Update: 28 April 2011

Wednesday, April 27, 2011

CPO GT2 & RJ1 Trade Update: 27 April 2011

Tuesday, April 26, 2011

CPO GT2 Trade Update: 26 April 2011

Monday, April 25, 2011

CPO GT2 Trade Update: 25 April 2011

Wednesday, April 20, 2011

CPO RJ1 Trade Update: 20 April 2011

Tuesday, April 19, 2011

CPO GT2 Trade Update: 19 April 2011

Monday, April 18, 2011

CPO GT2 Trade Update: 18 April 2011

Thursday, April 14, 2011

CPO GT2 & RJ1 Trade Update: 14 April 2011

Wednesday, April 13, 2011

CPO GT2 Trade Update: 13 April 2011

Monday, April 11, 2011

CPO GT2 Trade Update: 11 April 2011

Thursday, April 7, 2011

CPO GT2 Trade Update: 7 March 2011

*CPO RJ1 still same position holding LONG 3311 for June contract..

*FKLI using RJ1 also the same position LONG 1541..

Tuesday, April 5, 2011

CPO GT2 Trade Update: 5 April 2011

Friday, April 1, 2011

Thursday, March 31, 2011

CPO GT2 & FKLI RJ1 Trade Update: 31 March 2011

*CPO RJ1 still holding LONG 3311 June contract...

*FKLI using RJ1 i rollover today at LONG 1541 for April month..

Wednesday, March 30, 2011

CPO RJ1 Trade Update: 30 March 2011

*CPO for GT2 still the same maintain my LONG 3347 for June contract..

*FKLI using RJ1 still holding LONG 1519.5 for March.. rolling in tomorrow..

Tuesday, March 29, 2011

FKLI RJ1 Trade Update: 29 March 2011

*CPO RJ1 still maintain June contract SHOT 3311..

*CPO GT2 still the same LONG 3347 for June contract.. hmmmm

Friday, March 25, 2011

Thursday, March 24, 2011

CPO GT2 Trade Update: 24 March 2011

*CPO RJ1 still the same holding SHOT 3311 for June contract..

*FKLI RJ1 still holding SHOT 1479.5.. die!!

Wednesday, March 23, 2011

CPO GT2 Trade Update: 23 March 2011

*CPO for RJ1 holding SHOT 3311 for June contract..

*FKLI using RJ1 still same position, holding SHOT 1479.5 for March..

Tuesday, March 22, 2011

CPO RJ1 Trade Update: 22 March 2011

*CPO for GT2 trade still steady holding SHOT 3434 for June contract..

*FKLI using RJ1 still no change, SHOT 1479.5 for March..

Monday, March 21, 2011

CPO GT2 Trade Update: 21 March 2011

*CPO for RJ1 still the same holding June contract LONG 3414..

*FKLI using RJ1 still holding SHOT 1479.5..

Friday, March 18, 2011

CPO RJ1 Trade Update: 18 March 2011

*CPO for GT2 still the same maintain my LONG 3360 for June contract..

*FKLI with RJ1 still maintain SHOT 1479.5 ... hmmmm

Tuesday, March 15, 2011

CPO GT2 Trade Update: 15 March 2011

*CPO for RJ1 trades still the same holding SHOT 3570 for May contract, no rollover yet!!

*FKLI also the same using RJ1, still holding SHOT 1479.5 (roll)

Monday, March 14, 2011

CPO GT2 Trade Update: 14 March 2011

*CPO for RJ1 still intact, maintain SHOT 3570 for MAY contract..

*FKLI using RJ1 still maintain SHOT 1479.5..

Malaysian Toilet True Story.. hahahaha

Kenapa tandas berbayar keadaannya lebih MOTHERFUCKING SHIT dari tandas free? Bukankah tandas berbayar seharusnya lebih terjaga? Have you guys tried using the toilet inside Hentian Puduraya before? A few years ago before it was closed for renovation, I had an awesome urge to take a shit there ( I was picking up my sister). Went to the toilet, paid the 20 cents entrance fee and went to look for an empty stall. First one was clogged with solid shit encrusted inside the toilet bowl like dried Milo. The second one does not have a functioning flush. A brown floating turd bobbed on the surface of rancid yellow piss. The third one is just a little bit cleaner than the toilet from Trainspotting

I really need to take a shit but I lost the nafsu to berak then and there. Ran out while at the same time squeezing my sphincter all the way to the Nandos next to Puduraya. Went into the loo and I let it rip. It was still the best shit I ever had. It went out in one awesome explosion that would make the dudes on Jackass happy. You'll never know how awesome an invention a sitting toilet connected to a sewage system is until you are denied one at a very crucial shitting moment.

Sunday, March 13, 2011

Small Account Statement as 10 March 2011

*This is my latest account statement as of 10 March 2011 compared to my first statement i posted May 2010 from roughly about RM4k +/-

*This is my latest account statement as of 10 March 2011 compared to my first statement i posted May 2010 from roughly about RM4k +/-Saturday, March 12, 2011

Soybean Oil Trade Signal

2)02.09>SHOT 40.10-BUY 40.91 = -0.81 (05.06)

3)03.09>LONG 40.91-SELL 43.57 = +2.66 (04.10)

4)04.10>SHOT 43.57-BUY 46.82 = -3.25 (11.10)

5)11.10>LONG 46.82-SELL 49.01 = +2.19 (27.10)

6)27.10>SELL 49.01-BUY 49.61 = -0.6 (28.10)

7)28.10>LONG 49.61-SELL 48.94 = -0.67 (29.10)

8)29.10>SHOT 48.94-BUY 49.61 = -0.67 (11.01)

9)11.01>LONG 49.61-SELL 52.57 = +2.96 (11.11)

10)11.11>SHOT 52.57-BUY 50.40 = +2.17 (18.11)

11)18.11>LONG 50.40-SELL 48.95 = -1.45 (22.11)

12)22.11>SHOT 48.95-BUY 49.54 = -0.59 (24.11)

13)24.11>LONG 49.54-SELL 50.19 = +0.65 (29.11)

18)15.12>SHOT 54.64-BUY 54.92 = -0.28 (20.12)

19)20.12>LONG 54.92-SELL 56.50 = +1.58 (29.12)

20)29.12>SHOT 56.50-BUY 56.71 = -0.21 (31.12) >>2010= +5.03

***********************************************************

21)31.12>LONG 56.71-SELL 56.93 = +0.22 (04.01)

23)05.01>LONG 57.91-SELL 56.94 = -0.97 (06.01)

24)06.01>SHOT 56.94-BUY 58.07 = -1.13 (18.01)

26)20.01>SHOT 57.50-BUY 58.08 = -0.58 (23.01)

27)23.01>LONG 58.08-SELL 56.99 = -1.09 (24.01)

28)24.01>SHOT 56.99-BUY 57.16 = -0.17 (27.01)

30)04.01>SHOT 58.77-BUY 59.33 = -0.56 (06.02)

31)06.02>LONG 59.33-SELL 58.60 = -0.73 (07.02)

32)07.02>SHOT 58.60-BUY 58.99 = -0.39 (08.02)

33)08.02>LONG 58.99-SELL 59.09 = -0.10 (11.02)

34)11.02>SHOT 59.09-BUY 57.08 = +2.01 (17.02)

35)17.02>LONG 57.08-SELL 56.58 = -0.50 (18.02)

36)18.02>SHOT 56.58-BUY 59.69 = -3.11 (07.03)

37)07.03>LONG 59.69-SELL 55.54 = -4.15 (11.03) >>2011 = -10.56

38)11.03>SHOT 55.54-BUY ?? =

TOTAL POINTS = -5.53

Friday, March 11, 2011

CPO GT2 Trade Update: 11 March 2011

*CPO RJ1 still on course, still steadily maintaining SHOT 3570.. yahoooo!!

*FKLI also still the same holding typical RJ1 SHOT 1479.5 (roll)

Thursday, March 10, 2011

CPO GT2 Trade Update: 10 March 2011

*So officially for today i intraday CPO May contract with SHOT 3501-BUY 3473 with a profit +56 points (2lots) and still holding the losing LONG 3598

*arrghhhhh what a swinging day..

Wednesday, March 9, 2011

CPO Trade Update + GT2 System: 9 March 2011

*CPO i turn SHOT 3570 today for May contract..

*CPO using my new GT2 system i turn LONG 3598 today, locking in +27 points profit from previous SHOT 3625..

*FKLI still same story maintain March SHOT 1479.5...

My 2 System: Rojak vs New system

# From 1st January 2011 to date: RS up +42 points vs NS up +568 points

# Trades: RS= 6 trades (Win 2, Lose 4) vs NS= 20 trades (Win 11, Lose 9)

# Average win/lose: RS= +192 from 2 wins, -85.5 from 4 losses vs NS= +79.2 from 11 wins, -33.6 from 9 losses.

# Biggest win/lose: RS= +200 win, -127 lose vs NS: +192 win, -106 lose

*hmmmm... my proven Rojak System "kena" trashed by my New System that still without name... hahaha

Tuesday, March 8, 2011

CPO Trade Update for New System: 8 March 2011

CPO 2011 (GT2 System Performance)

16)31.03>SHOT 3302-BUY 3343 x 2lots= -82 (31.03)

18)07.04>SHOT 3339-BUY 3342 x 2lots= -6 (07.04)

19)11.04>SHOT 3425-BUY 3344 = +81 (13.04)